Tax

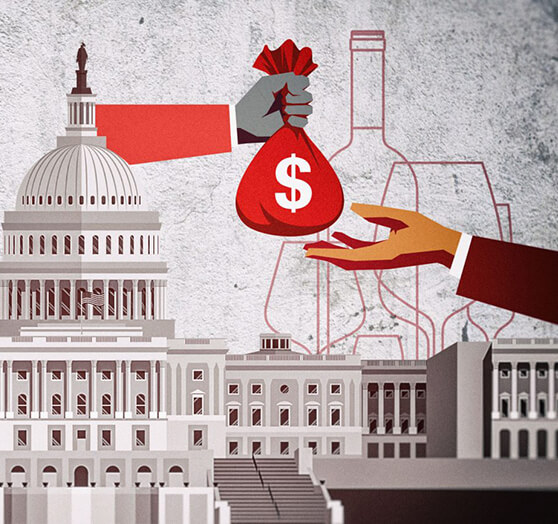

Excise Tax

Our Excise Tax services are designed to help businesses manage and comply with the complexities of excise tax regulations. Excise tax can apply to a variety of goods and services, and navigating these requirements can be challenging. We provide expert guidance to ensure that your business accurately calculates, reports, and remits excise taxes while remaining compliant with all applicable laws.

We start by assessing your business’s activities to determine the relevant excise tax obligations and rates. Our team assists in the preparation and submission of excise tax returns, ensuring that all necessary documentation is complete and accurate. We also help you understand any exemptions or special rules that may apply to your products or services, optimizing your tax positions.

Our ongoing support includes monitoring regulatory changes and providing continuous advice to keep your excise tax practices up-to-date. By partnering with us, you can minimize the risk of non-compliance and penalties, streamline your excise tax processes, and focus on your core business activities with confidence.

Get Started

Ready to transform

your business?

Our experienced team is here to provide the support and insights you need to thrive in a competitive landscape.